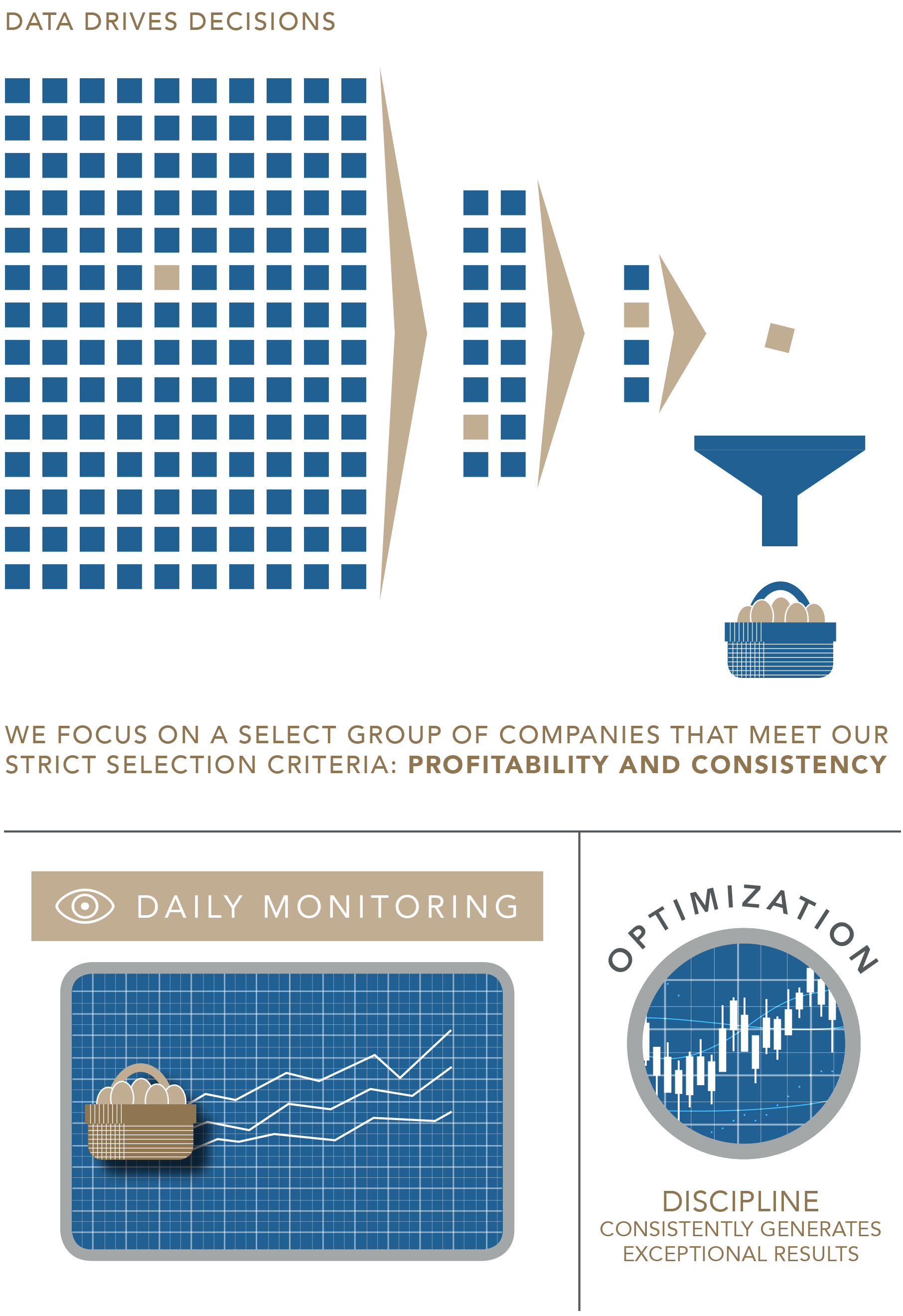

The Hillside Factor(y)

Our careful selection of investments is based on factors, which means that all the companies that we own for you will consistently deliver above average profits. Using strategies proven over time and disciplined investment principles, we produce exceptional results for our clients.

An Investment Approach Ideally Suited For Your Objectives

Hillside closely consults with our clients in determining the investment approach that is most aligned with their objectives and personal preferences. There are three different tracks we offer, and one of them is certain to be right for you.

In all three models, the PM looks to own a concentrated group of high quality companies that are watched very closely. The PM also has the flexibility to hold high levels of cash should the general market conditions warrant a defensive posture.

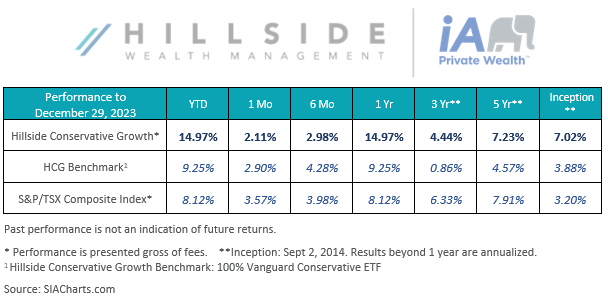

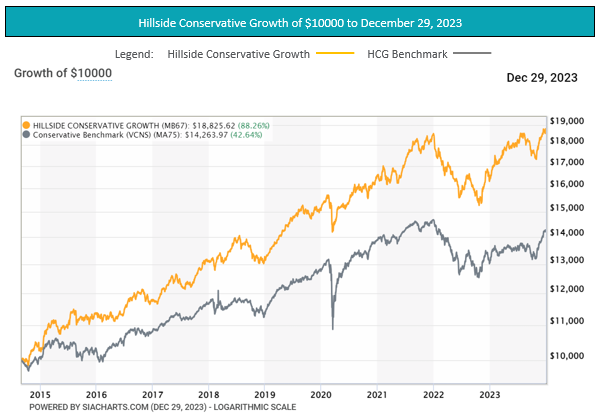

Investment Objective: The “Hillside Conservative Growth Portfolio” is geared toward individuals and their families who are looking for a reliable, consistent return on their investments, while minimizing risk.

The Portfolio Manager (PM) puts special emphasis on providing a positive return regardless of general market conditions. The PM's orientation is to target an average compound rate of return in the 3-5% range (net of fees) over an entire business cycle, ~ 6 to 8 years.

This model may never hold less than 50% of its assets in fixed income investments and must therefore also not hold more than 50% of its assets in equities.

To learn more about the portfolio, please be sure to email us.

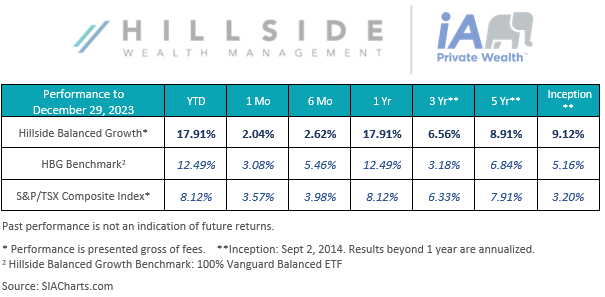

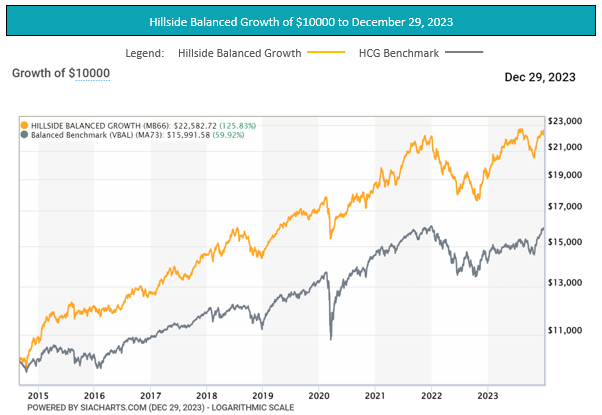

Investment Objective: The “Hillside Balanced Growth Portfolio” has been designed to address the objectives of clients and their families who wish to have the majority of their portfolios’ exposure to equities while maintaining exposure to more conservative asset classes to provide balance.

The goal is to realize returns in the 5-7% range (net of fees) over a period of 6 to 8 years.

This model may never hold less than 30% of its assets in fixed income investments and must therefore also not hold more than 70% of its assets in equities.

To learn more about the portfolio, please be sure to email us.

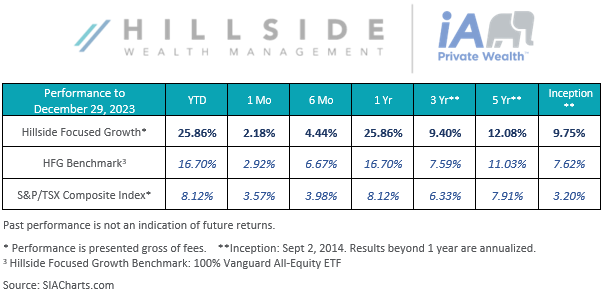

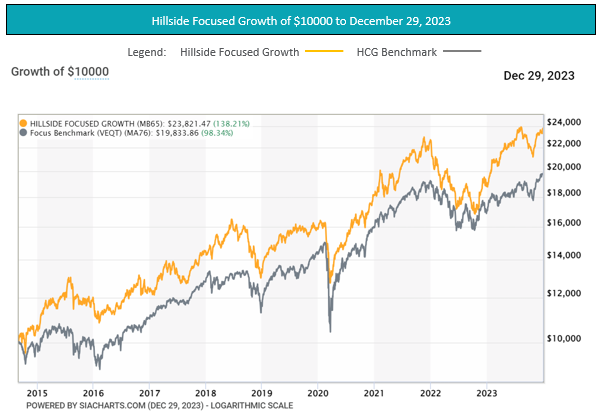

Investment Objective: The main objective of the “Hillside Focused Portfolio” is to derive maximum growth of capital, according to the risk tolerance of investors and their families. While protection of capital is still paramount, the PM works to deliver a 10%+ average return.

To learn more about the portfolio, please be sure to email us.